R.I.’s home supply drops further in first quarter

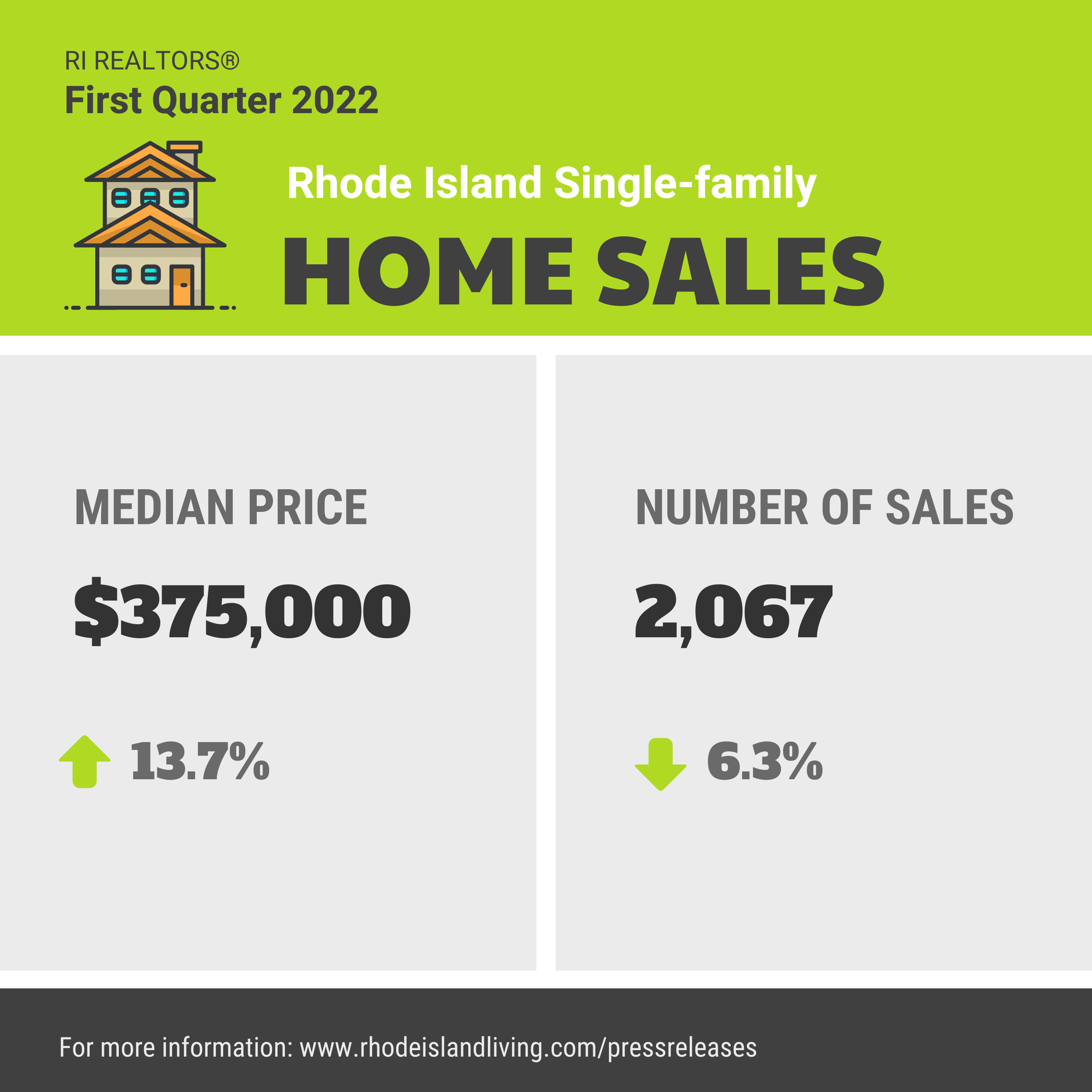

Warwick, R.I. – April 28, 2022 – The $375,000 median price of single-family homes sold in Rhode Island from January through March represented a 13.7% increase from the same time last year. In a statement released today, the Rhode Island Association of Realtors also noted another sharp drop in year-over-year inventory in the first quarter.

At its lowest point of the quarter, inventory fell to a .84-month supply, meaning that no homes would be available for sale within a month if no new listings were put on the market. A market balanced between supply and demand typically has a six-month supply of homes available. The lack of inventory and related increase in prices is causing sales to wane. The number of single-family home closings fell by 6.3% from a year ago.

“As interest rates rise and homes become less affordable, we expect to see some buyers drop out of the market which would lessen demand. That’s a step in the right direction so this could be the year that a correction takes hold. However, Rhode Island had a housing shortage before the pandemic so our state still has work to do to ensure that accessible housing is available. More new development is needed,” said Agueda Del Borgo, President of the Rhode Island Association of Realtors.

Condominium sales saw even more appreciation in median price, rising 22% to $303,100, while sales activity fell 9.5%. Condos are often an alternative option for buyers looking to purchase at lower price points. While the supply of condos also remained critically low in the first quarter, hovering just above a one-month supply, the condo market did offer slightly more options for buyers than were available in the single-family home market.

At $400,000, the multifamily home sector’s median price was the highest of all categories and increased 19.4% from the first quarter of 2021. The median sales price of multifamily homes pre-pandemic was typically less than that of single-family homes but the allure of high rental income has pushed multifamily home prices higher. Inventory dropped to a low of a .8-month supply in February and sales fell 5.8% in the first quarter.

Pending sales, an indication of future closed sales in the weeks ahead, fell throughout the first quarter among all residential property types.

Months Supply: Click here for interactive display

About the Rhode Island Association of REALTORS®

The Rhode Island Association of REALTORS®, one of the largest trade organizations in Rhode Island with more than 5,000 members in nearly 1,000 offices, has been serving Rhode Islanders since 1948. Advocating for Rhode Island's property owners, the Rhode Island Association of REALTORS® provides a facility for professional development, research and exchange of information among its members and to the public and government for the purpose of preserving the free enterprise system and the right to own real property. Last year, RI Realtors transacted $6.9 billion in residential real estate sales and $7.1 billion in total sales and rentals including commercial transactions.

The Association is one of more than 1,500 boards and associations that comprise the National Association of REALTORS® (NAR). The National Association of Realtors®, “The Voice for Real Estate,” is America's largest trade association, representing over 1.5 million members involved in all aspects of the residential and commercial real estate industries and who subscribe to a strict Code of Ethics.

REALTOR® is a federally registered collective membership mark which identifies a real estate professional who is member of the NATIONAL ASSOCIATION OF REALTORS® and subscribes to its strict Code of Ethics.